Compound Interest essential link Calculator

Articles

However, you need to use in money the price of company-given insurance coverage which is more the cost of $50,100000 out of visibility smaller by one number you pay to the the brand new acquisition of the insurance. For individuals who discover a cost in the percentage out of money otherwise view for back shell out, you need to are the amount of the new commission on the money. Including repayments made to your to have problems, unpaid life insurance coverage advanced, and you will outstanding medical health insurance superior. They ought to be claimed to you by your boss to your Form W-2. When you are hitched but document a different get back, you might take borrowing simply for the fresh tax withheld out of your own money. Do not were one matter withheld from the wife or husband’s income.

- It area summarizes important taxation change one to got impact inside the 2024.

- Region I out of Function 2848 have to declare that you’re granted expert to sign the brand new get back.

- Lead File are a great filing option for taxpayers within the acting states with relatively easy tax returns reporting just certain kinds of money and saying particular credits and write-offs.

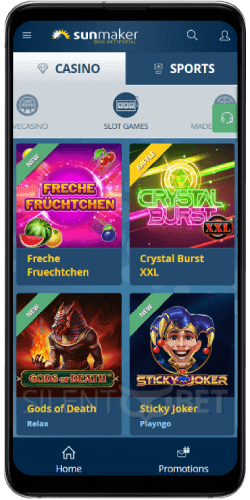

Ranks the top ten Gambling enterprise Application Organization: essential link

You’ll need to proceed with the best coins from the globe security and prevent meme gold coins that will not even is be found in the a number of years. Betpanda can be acquired into the numerous dialects while offering twenty four/7 support service via alive chat and you can current email address, making sure all of the associate gets the assist they want quick. Judge laws and regulations for various brands can vary a bit and create situations where they can’t take on players from all around the country. The newest safest opportinity for participants in order to browse that it, regarding avoiding throwing away date, is always to just come across web sites you to undertake people from your own certain venue. To have Us citizens, Europeans and you may around the world participants, allow me to share the greatest $1 also offers for every.

Solar Areas are forecast getting founded to your western coastline which have a starting age group out of 1000MW. The one and only strength bringing business within the Karachi try K-Digital. But not HUBCO is a different Electricity Music producer (IPP) one owns couple biggest powerplants. Naimatullah Khan try the original Nazim out of Karachi inside the Union Council months, when you’re Shafiq-Ur-Rehman Paracha are the initial district dexterity officer of Karachi. Syed Mustafa Kamal is selected Area Nazim out of Karachi to advance Naimatullah Khan inside 2005 elections, and Nasreen Jalil are chose because the City Naib Nazim.

- See Hobby not to have money lower than Almost every other Income, afterwards.

- Such as, if you buy thousands of seats in order to regional large college or university basketball games and give a couple of passes to every of a lot customers, it’s always sufficient to listing a general breakdown of your own readers.

- Deluxe real estate agents inside Los angeles and you can similar locations, usually earn earnings anywhere between 2% to three% for each and every transaction.

- Even though you do not discover a questionnaire 1099-INT, you should still statement all of your interest money.

- 550 boasts examples appearing ideas on how to declaration such numbers.

- And make that it election, you ought to browse the field on line 18 away from Plan A (Setting 1040).

KatsuBet – fifty Free Revolves To possess C$step one

915 lower than Swelling-Contribution Election to see if deciding to make the election often decrease your nonexempt advantages. One talk in addition to teaches you how to make the newest election. Or no of the professionals try taxable for 2024 and tend to be a lump-share benefit percentage that has been to have an early season, you’re in a position to reduce the taxable number to the lump-sum election. Report the web benefits (the quantity out of box 5 of all your own Models SSA-1099 and Variations RRB-1099) on the Mode 1040 or 1040-SR, range 6a. When you are married processing independently therefore stayed aside from your lady for all away from 2024, as well as enter “D” to the right of the term “benefits” to the Function 1040 or 1040-SR, range 6a. Which section as well as doesn’t security the brand new tax laws for overseas public shelter professionals.

You create shipments at the many different towns on the a path one to starts and finishes at your workplace’s team premise and this has a halt during the company site between a couple shipments. You could be the cause of essential link these using an individual number from miles inspired. You can preserve an adequate list to have parts of a tax 12 months and use one to number to prove the degree of organization otherwise investment fool around with for the whole season.

Such, for many who deposit $ten and you can allege a 100% suits incentive, you’ll discover a supplementary $10—providing you with $20 to try out which have. When you are matches bonuses will likely be perfect for improving quicker places, they’lso are rarely designed for $step 1 places. For individuals who’re also seeking take advantage of matched now offers, listed below are some the courses on the $5 deposit casinos and you can $10 added bonus casinos as an alternative. To possess Canadian players that looking having fun with crypto due to their online gambling needs, 7Bit Gambling enterprises is a solid choice. So it 50 totally free spins for starters$ put gambling establishment not merely supporting cryptocurrencies including Bitcoin, Ethereum, and you may Litecoin but also conventional choices such as bank cards, e-wallets, and much more. 7Bit along with boasts one of the greatest game catalogs, featuring more 5500 titles of 107 app organization.

Simply how much try 9 numbers?

Using e-document doesn’t apply to your chances of a keen Irs study of your come back. You need to use Form 1040 or 1040-SR in order to declaration all types of earnings, write-offs, and you can credit. You need to are income from functions your performed while the an excellent minister whenever calculating the web money from mind-a job, if you don’t features an exception of thinking-a job income tax. And also this applies to Christian Technology practitioners and you will members of a religious buy who’ve not pulled a guarantee of impoverishment. When you’re 65 otherwise more mature at the end of the brand new season, you might tend to have a higher level of gross income than other taxpayers before you could need document.

We Read the Gambling establishment’s Profile

If you overstate the level of nondeductible benefits on your Function 8606 for income tax year, you must shell out a penalty from $100 for every exaggeration, except if it actually was due to reasonable lead to. Otherwise report nondeductible benefits, all of the contributions for the antique IRA would be addressed as the deductible benefits when taken. All of the withdrawals out of your IRA was taxed unless you is inform you, having high enough research, one nondeductible contributions have been made. In the 2024, you used to be included in a retirement package at the office. Because you were included in a pension bundle and your modified AGI is actually more $87,100, you simply can’t subtract the brand new $7,100000 IRA sum.

His expertise in the net casino community can make your an enthusiastic unshakable pillar of your Gambling establishment Wizard. We’ve produced a list of most other dependable casinos with brief deposit limits out of $ten otherwise quicker, easily obtainable in the usa. If you are searching making a little gambling enterprise deposit playing on line in the united states, you need to view sweepstakes gambling enterprises. Those sites enables you to put having PayPal or other regional Western commission options, completely legally, so long as sweeps perks are permitted on your own state. Customer support try integral to a fantastic experience at any low minimum put internet casino.

Make sure you here are some all of our guide to your 120 100 percent free Spins real cash incentives. The brand new Brango Local casino $125 100 percent free chip is one of the most rewarding no-deposit now offers offered now. It will become more glamorous whenever combined with the newest zero bet deposit suits. The brand new $125 processor chip lets you try RTG online game with a bona-fide chance in order to cash out. Every piece of information inside article is actually for educational motives simply and won’t make up monetary guidance.

Find Very early Distributions less than What Serves Lead to Charges or Extra Taxation? Excessive benefits can also be recovered tax free because the discussed below Just what Serves Result in Charges otherwise A lot more Taxes, afterwards. You must document Mode 8606 so you can report 2024 conversions out of old-fashioned, September, or Simple IRAs so you can a good Roth IRA inside the 2024 (if you do not recharacterized the whole matter) and to profile the total amount to include in income. If you withdraw assets of a classic IRA, you might roll-over part of the detachment tax-free and you may secure the remainder of they. The amount you keep will normally getting taxable (except for the brand new part which is a return from nondeductible benefits).

Although not, if you’d like to have fun with one dollars, i suggest starting with slot machines. You can find 1000s of courtroom on line football wagering platforms that offer totally free money immediately after registering. Complete with legitimate football betting platforms such DraftKings, and every day dream football systems for example ParlayPlay. Naturally, most of these platforms also require professionals to help you possibly create an excellent basic put otherwise put a primary wager to earn one incentive money. Fliff is one of the most novel sports wagering platforms operating in the us now. Which platform will act as a social sportsbook which can be starred free of charge.

The articles, entertaining equipment and other articles are provided for your requirements for free, since the self-assist systems as well as informative objectives simply. NerdWallet does not and should not make sure the accuracy or usefulness from people information concerning your individual issues. Examples is actually hypothetical, and now we remind one to find personalized suggestions from licensed benefits of specific money items. The quotes derive from past business efficiency, and you can earlier overall performance isn’t a promise from coming performance. Basically, $1 put gambling enterprises can be worth it in case your objective are informal activity and you will experimenting with an internet site cheaply.

Brokers’ commissions paid in exposure to your own conventional IRA is subject on the share limit. Their conventional IRA will likely be an individual senior years membership otherwise annuity. It may be element of possibly a sep otherwise an employer otherwise personnel association believe membership. Payment includes money out of self-work even though they aren’t subject to self-a career income tax because of your religious thinking. To possess information on your joint share restrict if you subscribe each other conventional and you can Roth IRAs, see Roth IRAs and you can antique IRAs, later on.